Thinking of buying crypto for Christmas? Here’s what you need to know

By now you’ve probably heard of the craze surrounding cryptocurrency – the two most recognisable being BitCoin and Ethereum.

There’s a lot of hype circulating at the moment, and if it’s got you wondering whether you should be buying “crypto” for Christmas, here are the three things you need to know:

- What would you actually be buying (ie what is cryptocurrency?)

- Should you believe the hype

- If you do purchase a cryptocurrency (or have done so already!), what do you need to be aware of?

What is cryptocurrency?

Cryptocurrencies, or “altcoins”, are a form of digital money primarily designed to be secure, and in many cases, anonymous. While there are over 1000 types of cryptocurrency, the two most notable are BitCoin and Ethereum. This digital currency is not dissimilar to conventional currency in some ways – you can make purchases with it (in some countries), and you use a digital “wallet” to store it; the key point of difference is that it is in no way associated with centrally regulated banking systems or governments. Many cryptocurrencies are organised through an online network called BlockChain – an online ledger that records all of the transactions securely in one place.

BitCoin was legalised in Australia by the RBA in 2013. From July 1st 2017, the Australian government started treating BitCoin “just like money” (meaning you need to include all BitCoin-derived income in your tax return).

You can purchase BitCoin and other cryptocurrencies on an exchange, and once you purchase the BitCoins using Australian dollars they will become available in your account for you to send elsewhere.

Ok, sounds interesting – should I believe the hype?

To help us answer this question, we spoke to Dinyar Irani, Co-Chief Investment Officer of Innova Asset Management, for his thoughts on the current BitCoin “bubble” we seem to be in the middle of.

What you need to consider with any cryptocurrency is the “stability” or lack thereof in the current suite of pricing.

One of the purposes of a viable/desirable currency is that it should be a reasonably reliable store of value for savings. If a currency is capable of rising or dropping by 30% in a week, then it will probably be seen more as a speculation than a store of value.

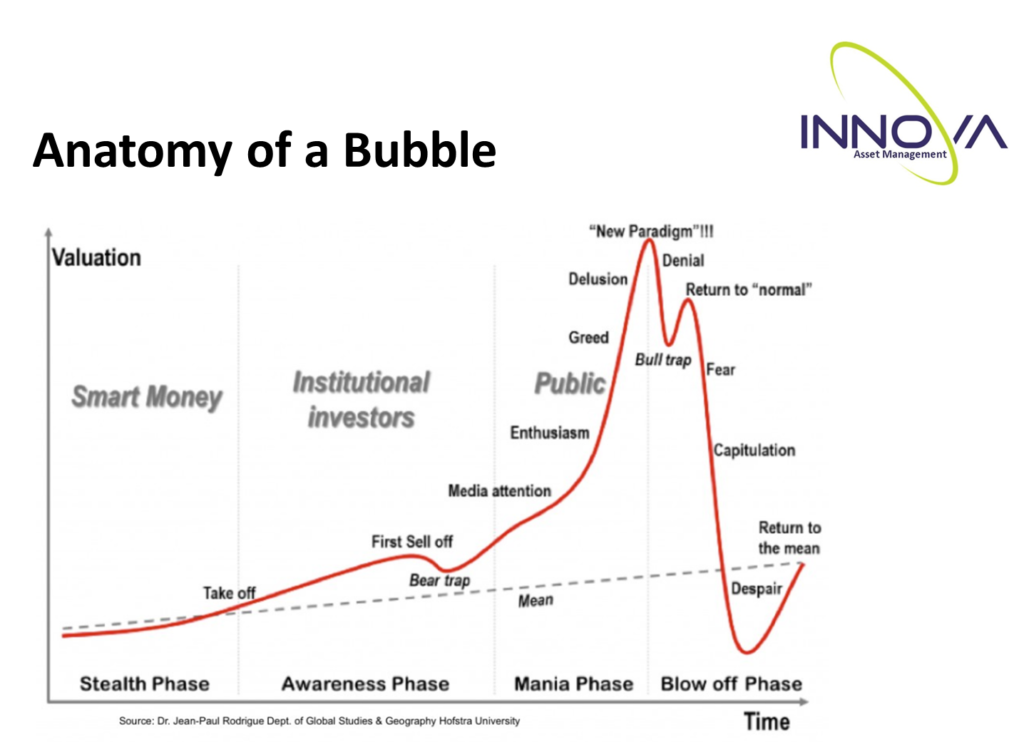

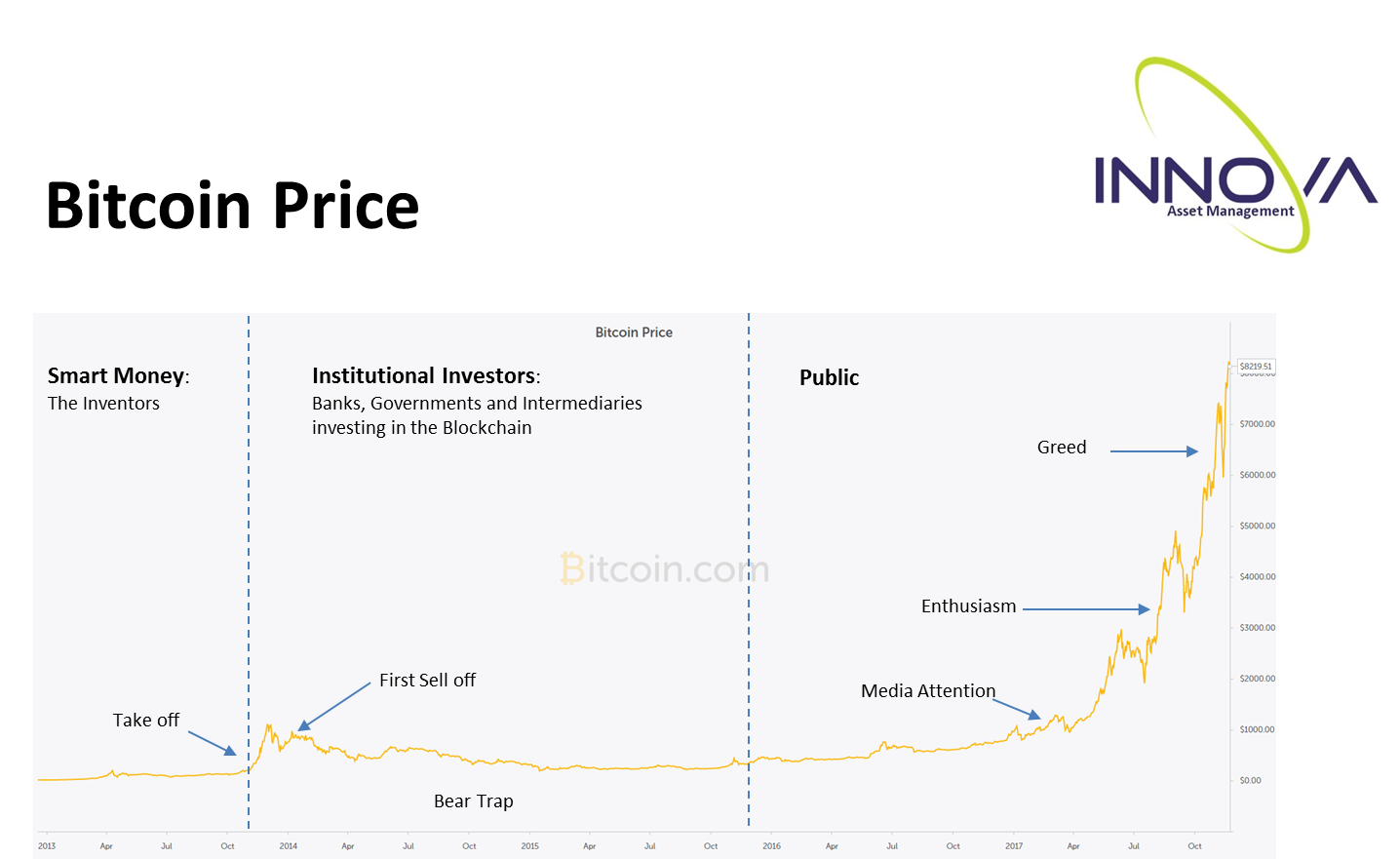

The current BitCoin trend has many similarities to a “Bubble”, when it will crash is difficult to foresee! Source: Innova Asset Management, November 2017

I think eventually cryptocurrencies will go mainstream, but I also think that governments will get involved in them ultimately, as they simply have too much to lose if they leave their move too late and don’t involve themselves (in terms of the power to issue and control the money supply, the ability to track and tax cash flows etc), and they will just have to find a way to get into the game.

If we use the history of empires as a guide, typically the one way ruling conquerors and kings forced the newly conquered peoples to adopt their currency was by saying to them, “I will only accept payment of taxes and tribute with this currency, my currency, which is going forward, your new currency”.

Perhaps the US Fed will create “FedCoin” and say that federal taxes have to be paid in this medium, or perhaps even an intergovernmental body like the World Bank or the IMF will issue their own version of a cryptocurrency at some point which they will be able to control and track and tax.

Still sounds like something you want in your stocking this Christmas?

If you do purchase a cryptocurrency (or have done so already!), what do you need to be aware of?

- Only invest what you’re prepared to lose: There is a bit of a bubble/mania occurring in cryptos, with lots of speculation. It’s always hard to pick the top in bubbles – they can endure for a long time and reach dizzying heights before crashing, so you need to be aware of the risk.

- Don’t forget about the tax: According to the Australian Taxation Office, “Transacting with BitCoin is akin to a barter arrangement, with similar tax consequences. Our view is that BitCoin is neither money nor a foreign currency, and the supply of BitCoin is not a financial supply for goods and services tax (GST) purposes. BitCoin is, however, an asset for capital gains tax (CGT) purposes”.The rules can be more complicated depending on the entity that owns the currency and if you’re trading your cryptocurrency on an exchange, so we’d suggest you speak with your accountant to confirm the correct tax treatment. We work hand in hand with O’Connells OBM, so if you are an existing client, make sure you let us know about any cryptocurrency investments you might have so that we can ensure this has been considered for your personal situation.

- There are other options for investment: If cryptocurrency sounds too complicated, or is not an investment you are interested in, don’t worry – there are many other investment opportunities out there that could be better suited to your goals. If you’re interested in reviewing your investment portfolio (or starting one!) to make sure your money is working for you, take advantage of our complimentary investment and superannuation review.

General Advice Warning

Past performance is not an indicator of future performance. The information provided in this article is general in nature and does not take into account your particular investment objectives, financial situation or insurance needs; we therefore recommend you seek advice tailored to your individual circumstances before making any specific decisions. Liberum Financial and its advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306. Innova Asset Management is a Corporate Authorised Representative of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357 306.

Comments are closed.