When was the last time you reviewed your investment strategy?

In an environment where nothing is overly cheap, more than ever it is critical to ensure you are well diversified and your portfolios are regularly reviewed.

While there is no one size fits all approach when it comes to determining the strategy and investment mix that will suit your journey to financial freedom, there are a host of hot spots we'd recommend you review and consider regularly with your financial adviser to ensure your investment decisions and broader strategy align to your longterm financial and lifestyle goals.

Download our Portfolio Self Assessment Checklist

We’ve created an investment strategy checklist to help you “run the rule” over your own portfolio and highlight any areas you should consider reviewing further.

Portfolio mix: the risks of concentrated portfolios and benefits of diversification

There is a lot of diversity in the investment products available in the market today; shares, managed funds, bonds, options, index funds and property to name a few. The simplest to understand, aside from property, is shares, and this is where a lot of investors start.

Many retail investors may start by picking 1 or 2, maybe even a small portfolio of shares from companies that they have heard of and understand, leaving open the very real possibility of holding a concentrated portfolio. In the event of a market downturn, or some specific event affecting one of the investments held, the investor may see very large swings in the value of their portfolio.

Even in a larger portfolio holding, some investments may be correlated and experience movement in the same direction at the same time – as in the example below where an investor may hold Australian property and a portfolio of Australian shares.

MANAGING RISK

Diversifying a portfolio isn't as simple as just buying a range of different investments. A well-diversified portfolio contains a range of products that are not correlated, such that some positively performing investments cancel out the negative performance of others.

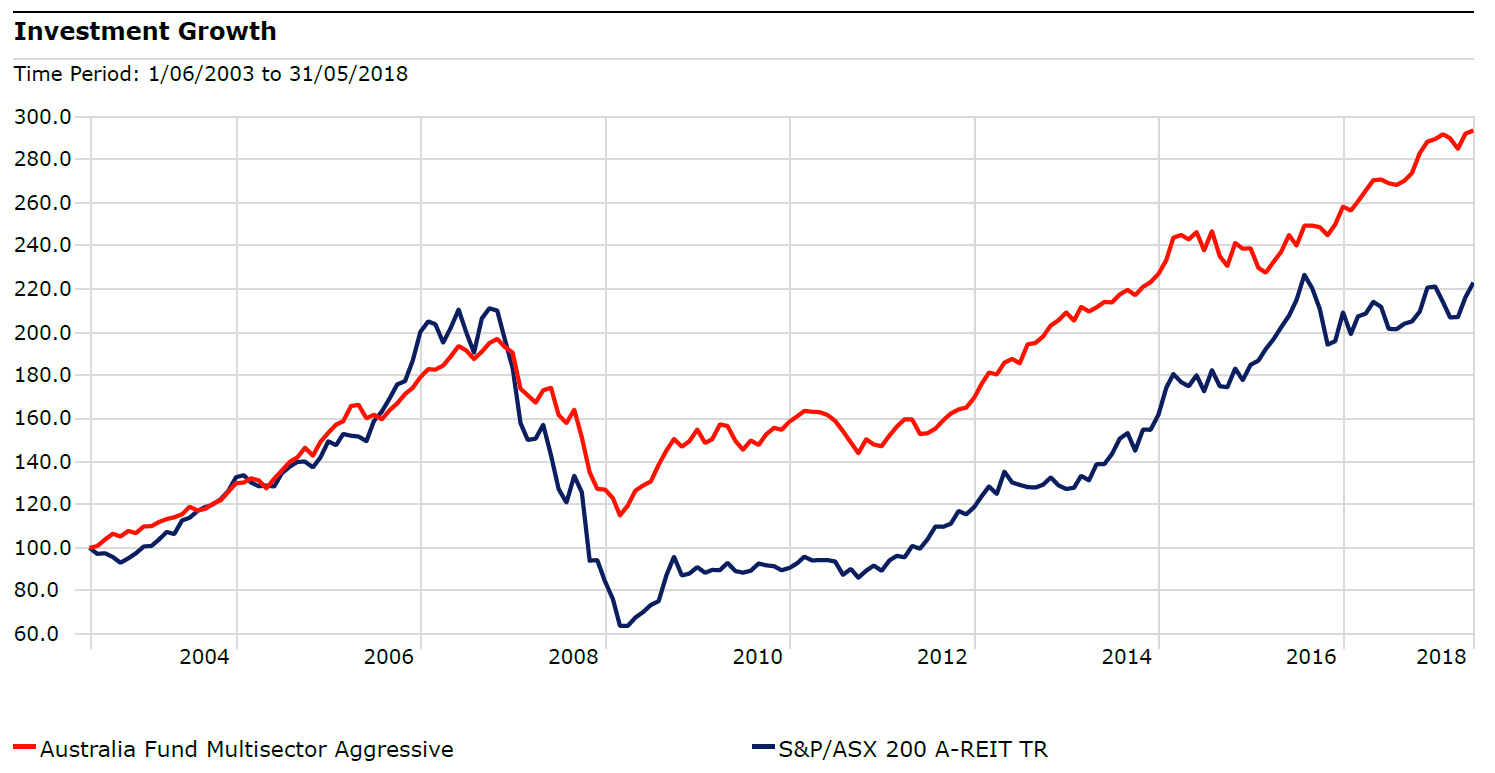

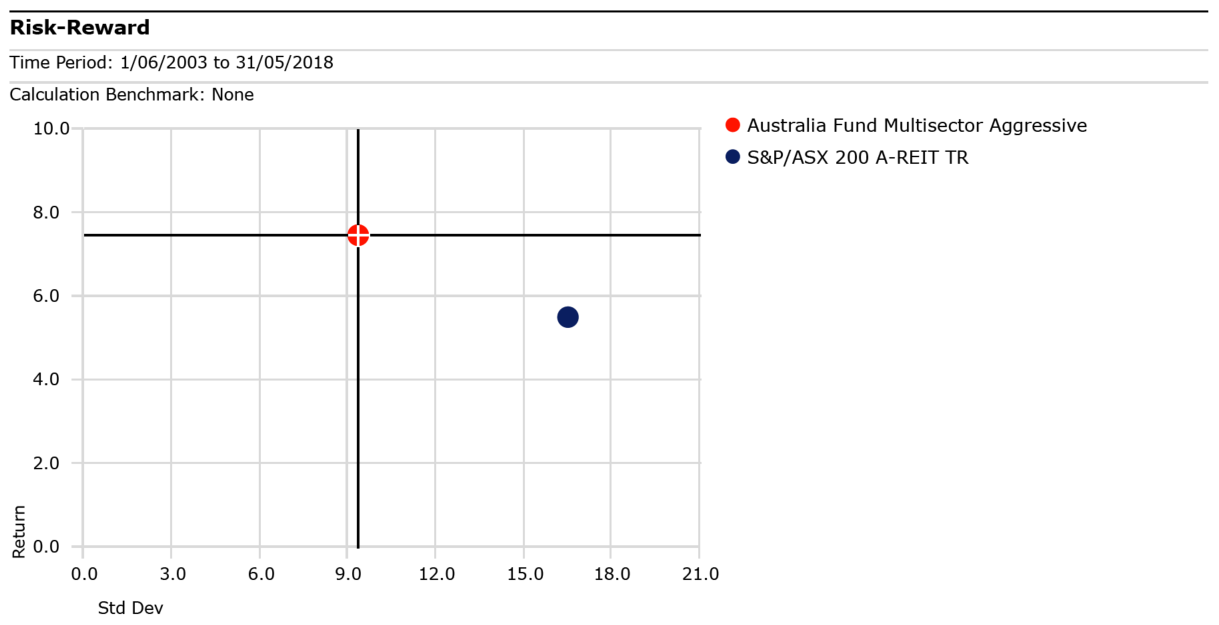

Shares in particular offer the opportunity to diversify across different sectors, offering better risk-adjusted returns than investment solely in property. The graphs on the right show the performance of a diversified share portfolio (in red) vs the performance of ASX listed Real Estate Investment Trusts (in blue) over the last 15 years, and their risk/return profile. You can see the difference in performance is quite substantial.

Holding a portfolio that is concentrated in a specific sector/region/asset class, regardless of how many investments are held, can lead to higher volatility in the portfolio's performance and larger drawdowns. A diversified portfolio should have a mix of; domestic and international investments, shares (in a range of sectors internationally and domestically), property, bonds, cash and alternatives. Each individual investment should not make up a large percentage of the overall portfolio, as concentration in the portfolio decreases the benefits of diversification.

If you'd like a fresh set of eyes to get over your portfolio, take advantage of our complimentary investment strategy review. The outcome of the review is a list of suggested action points to implement now and/or the identification of points to explore further to ensure your investment strategy is tailored to helping you achieve your financial freedom.

Performance of a diversified share portfolio (Red) vs the performance of ASX listed Real Estate Investment Trusts (Blue) over the last 15 years. Source: Innova Asset Management

The difference in risk/return profiles for a diversified share portfolio (Red) vs the performance of ASX listed Real Estate Investment Trusts (Blue) over the last 15 years. Source: Innova Asset Management

Register for a complimentary strategy review

If there are any areas in particular that you’d like a fresh set of eyes to go over – take advantage of our complimentary investment strategy review where we’ll check in on your portfolio or Self Managed Superannuation Fund’s investment mix, liquidity, and any risks you might not be aware of.

To register your interest in the review, simply complete your details using the form and we’ll be in touch shortly.