4 ways to make the most of your investment portfolio

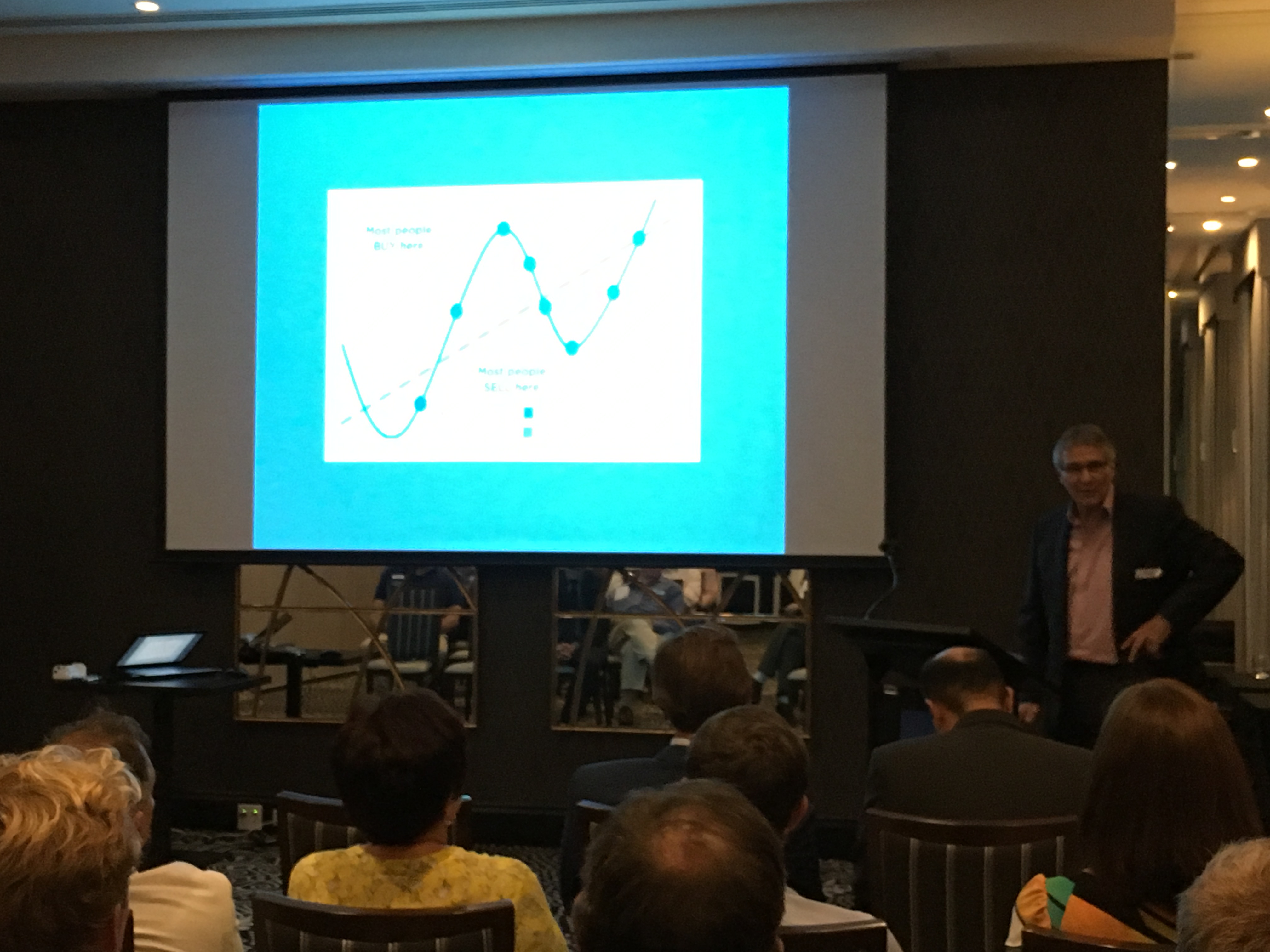

Last night we held our inaugural client event, where we joined in conversation with Dinyar Irani, chairman at Innova Asset Management, and David Dobbrick, financial planner with Liberum Financial, to explore strategies to protect our investments.

For those that weren’t able to join us, we’ve made a copy of the presentation available here.

Among all of the charts are four important points we should all keep in mind when it comes to making the most of our portfolios:

- Ignore the noise – don’t let news headlines or speculation cloud your investment (or divestment) decisions;

- Diversify – in uncertain conditions, you’re better off diversifying, and investing smaller amounts in a greater variety of stock rather than cashing out or keeping all of your eggs in one basket;

- You only make a loss if you sell – even if prices drop, don’t be tempted to sell, because doing so realises a loss. Riding out volatility has proven to result in greater returns in the long run; and finally

- Opt for protection – if you’re concerned about your ability to ride out market volatility, you might like to explore protection strategies that help to cushion the impact of market downfalls.

There are a number of ways we can assist you to protect your investments and provide guidance on the various portfolio strategies.

If you’d like to discuss your portfolio, or your financial situation more generally, please feel free to take advantage of our no cost, no obligation consultation, which you can book online here.

Liberum Financial Pty Limited and its advisers are Authorised Representatives of Fortnum Private Wealth Pty Ltd ABN 54 139 889 535 AFSL 357306 trading as Fortnum Financial Advisers. The information contained within does not consider your personal circumstances and is of a general nature only. Liberum Financial strongly suggests that you should not act on it without first obtaining professional advice specific to your circumstances. This information is for Australian residents only.

Comments are closed.