A rough start to the year …seven reasons not to get too concerned though

- Financial markets have started the year on a rough note as last year’s worries about China and global growth in the face of US monetary tightening continue.

- This could drive more short term weakness. However, in the absence of US/global recession, which still seems unlikely, it’s hard to see a GFC style bear market.

- The key for investors is to recognise that shares offer a higher return potential after sharp falls, selling after big declines just locks in a loss and that dividend income from a well-diversified portfolio is little affected by share market volatility.

Introduction

2016 has started much where 2015 left off with basically the same worries driving another bout of share market falls. Geopolitical concerns have played a role but the main issues are uncertainty regarding the Chinese economy, wariness about the Fed raising interest rates and the impact of a rising US dollar and falling Chinese Renminbi.

Share markets have seen sharp declines so far this year (with US shares -5.2%, Eurozone shares -6.2%, Japanese shares -9.5%, Chinese shares -14.6% and Australian shares -6.8%) taking them back to around the lows seen during the second half of last year, commodity prices are down further with the oil price falling to its lowest since 2009 and bonds have rallied with safe haven buying. This note looks at the key issues.

Drivers behind of recent falls could linger for a while

The weakness seen so far this year started with declines in the Chinese share market and currency, sparking renewed concerns about the Chinese economy, not helped by some soft manufacturing data in the US and geopolitical concerns in the Middle East and around North Korea. The renewed depreciation in the value of the Renminbi is a key issue at present as its decline has helped drive upwards pressure in the $US by pushing down the value of other emerging market currencies, adding to weakness in oil and other commodity prices and keeping alive fears of some sort of emerging market crisis. Geopolitical issues have played a role – notably an intensification of tensions between Saudi Arabia and Iran along with a claimed H bomb test in North Korea.

There could still be more share market weakness to come in the short term: global growth worries centred on China and the US may linger; until the Fed starts to soften its stance on interest rate hikes market nervousness is likely to remain; it is not clear that the dynamic of a weaker Renminbi and tightening Fed putting upwards pressure on the $US and downwards pressure on commodities and hence emerging countries, is over; finally, some technical indicators can be interpreted as warning of further weakness.

Emerging markets have already fallen into a bear market, defined as a 20% decline. Further short term weakness could see more mainstream share markets fall into bear market territory as European and Australian shares are already down 18% from last year’s lows, Japanese shares down 17% and US shares down 10% from their 2015 highs.

Seven reasons not to be too concerned

But while risks remain high in the short term there are several reasons not to be too concerned. In other words, if we do go into a bear market in developed market shares it is likely to be relatively shallow unlike say the GFC falls of 50% plus and we continue to see shares having a better year this year than last.

First, the latest fall in Chinese shares arguably tells us more about regulatory issues and fears around the share market and currency rather than much about the economy. Recent economic data out of China has been mixed rather than outright negative. Rather the main drivers have been worries about new share supply following the end to a ban on selling by major shareholders, a new share market circuit breaker which perversely encouraged investors to bring forward selling, and a continuing depreciation of the Renminbi against the $US.

In terms of each of these: Chinese regulators have since announced a restrictive limit on the size of stakes that major investors can sell; the circuit breaker has now been suspended; and after a 6% plus depreciation in the value of the RMB since July the PBOC appears to be stepping up its effort to stabilise it and indeed some stability has returned in the last few days. Our view remains that Chinese growth this year will come in around 6.5% and ongoing stimulus measures appear to be gaining some traction in helping ensure this.

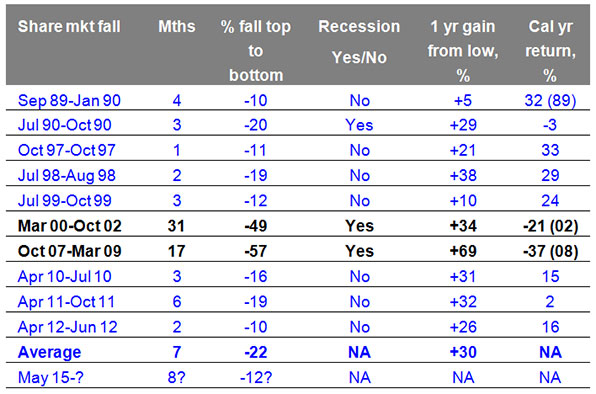

Second, a US recession is unlikely. This is critically important as the US share market sets the direction for global shares and the historical experience tells us that slumps in US shares tend to be shallower and/or shorter when there is no US recession and deeper and longer when there is (eg the tech wreck and GFC). See the next table. Sure US manufacturing is soft thanks to the strong $US and softening resource investment. But against this we have seen none of the excesses that precede recessions – like excessive growth in private debt, over investment in housing or capital good, high inflation or a speculative bubble. And most economic indicators in the US are okay highlighted by continuing strong jobs data which is serving to keep consumer spending firing even though the strong $US has damped US manufacturing. Nor have we seen 17 Fed interest rate hikes or the move to an inverted yield curve as we saw prior to the GFC.

Falls in US shares greater than 10% since 1989

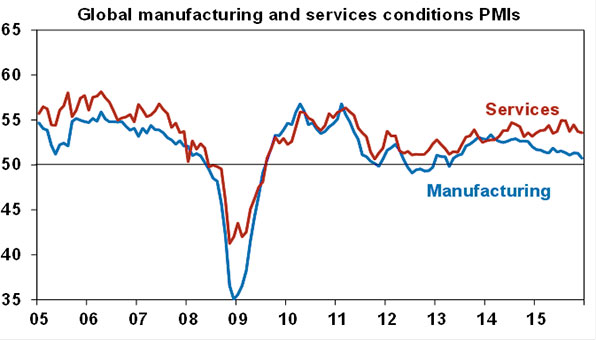

Third, the combination of okay economic data in China and the US along with good Eurozone indicators lately indicate the global economy is unlikely to plunge into recession. Sure while manufacturing conditions PMIs globally have been a bit softer lately, services conditions indicators remain reasonably solid.

Fourth, the current dynamic is very different to say the GFC as lower oil prices and commodity prices are providing a huge boost to consumers and most businesses. This is unlike the US housing slump at the time of the GFC that froze credit markets and led to a huge loss of household wealth or the surge in oil prices that preceded the GFC.

Fifth, monetary policy remains ultra easy. The Fed is very unlikely to undertake the four rate hikes it’s signalling for this year and other countries are still easing. This is very different to prior to the GFC when monetary tightening was the norm.

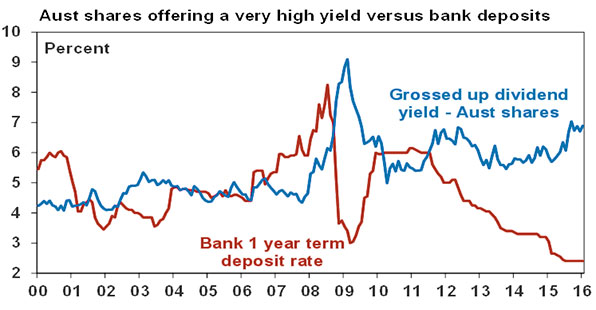

Sixth, renewed sharp falls have seen share market valuations become quite attractive. Our valuation measures for global and Australian shares have fallen back into very cheap territory. The gap between the grossed up dividend yield on Australian shares which is now nearly 7% and term deposit rates around 2.5% is back to around its highest level since the GFC.

While confidence in Chinese shares is being tested again, it’s worth noting that Chinese companies listed in HK provide particularly attractive long term value trading on forward PEs close to 6 times, less than half that of Australian shares.

Finally, there is a lot of pessimism around. This is evident in headlines screaming “RBS tells investors to sell everything” to “Collapse 2016”. Then again you might say such extreme views always exist. True. But they are suddenly all landing in my inbox telling me that such headlines are getting much more interest and belief. In some ways this is a negative as it is creating more fear amongst investors, but the flipside though is that when everyone fears the worst, often the surprise is that things turn out to be better.

Implications for Australia

The latest bout of global growth worries warns that the global environment Australia faces remains messy. So while rebalancing away from mining will continue to help we may face another year with growth stuck around 2.5%. Ongoing commodity price weakness means ongoing pressure on the budget deficit, points to more downwards pressure on the $A and more pressure on the RBA to cut interest rates again. Expect the $A to fall to around $US0.60 by year end and the RBA to cut the cash rate to 1.75%.

Implications for Investors

Investors need to allow for several things:

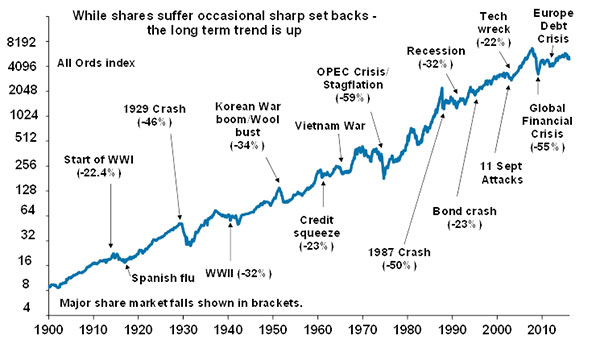

- First, shares invariably go through volatile patches with corrections and bear markets that can linger for a while, but also provide solid returns over the long term. Shares literally climb a wall of worry over many years with numerous events dragging them down periodically, but with the trend ultimately rising. This can be seen in the next chart.

- Second, China will remain a source of volatility as it transitions from relying on manufacturing & investment to services & consumption and as the authorities remain on a steep learning curve as they deregulate the Chinese economy. But this does not mean the Chinese economy is about to plunge into recession.

- Third, selling after a major fall just locks in a loss. Shares may only be down say 6% year to date but measured against last year’s highs many developed markets including Australian shares are already down 15 to 20%. For those concerned, one way to protect against downside is to have an exposure in unhedged global shares because further worries about global growth will further depress the $A which will in turn boost the value of offshore investments.

- Fourth, when shares and growth assets fall they are cheaper and offer higher long term return prospects. Many don’t see it that way given the rush for the exits but the key is to try and take advantage of the value that emerges.

- Finally, while shares may have fallen in value the dividends from the market as a whole have continued to increase. So the cash income flow you are receiving from a well-diversified portfolio of shares has continued to remain attractive, particularly against bank deposits.

The information provided is general in nature and does not take into account your particular investment objectives, financial situation or insurance needs; we therefore recommend you seek advice tailored to your individual circumstances before making any specific decisions.

Liberum Financial and its advisers are Authorised Representatives of Fortnum Private Wealth Pty Ltd ABN 54 139 889 535 AFSL 357306 Australia Credit Licence No 357306 trading as Fortnum Financial Advisers.

Reproduced with permission. Credit Original Source: For author information and disclaimers:-

http://www.ampcapital.com.au/article-detail?alias=/olivers-insights/january-2016/a-rough-start-to-the-year-seven-reasons-not-to-get

Comments are closed.