Short term pain, long term gain – how to manage your investments like Warren Buffett

Guest post by Dan Miles, Managing director and Co-Chief Investment Officer of Innova Asset Management

Warren Buffett is likely the most famous stock picker of all time. His track record compared to the broad S&P500 is amazing over the long term. $100 invested in Berkshire Hathaway A shares in March of 1980 (which you couldn’t have actually done, since the stock was trading at $290 a share) would have grown to more than $110,000 by March 2018, compared to the index which would have grown to $2,725.

If Warren Buffett was your investment adviser

I doubt anyone would say that they wouldn’t want Warren Buffett’s track record. But would you have actually stayed invested with him if he was your investment manager/adviser?

We regularly hear clients questioning why a certain manager or strategy is in their portfolio if it underperforms the market by 5% or as much as 10% – but what about Warren Buffett? How far from the index do you think he has deviated?

Most investors are shocked to know that Buffett has underperformed the broader market by as much as 50% in a 12 month period, and has had regular 12 month periods underperforming by 20% and greater.

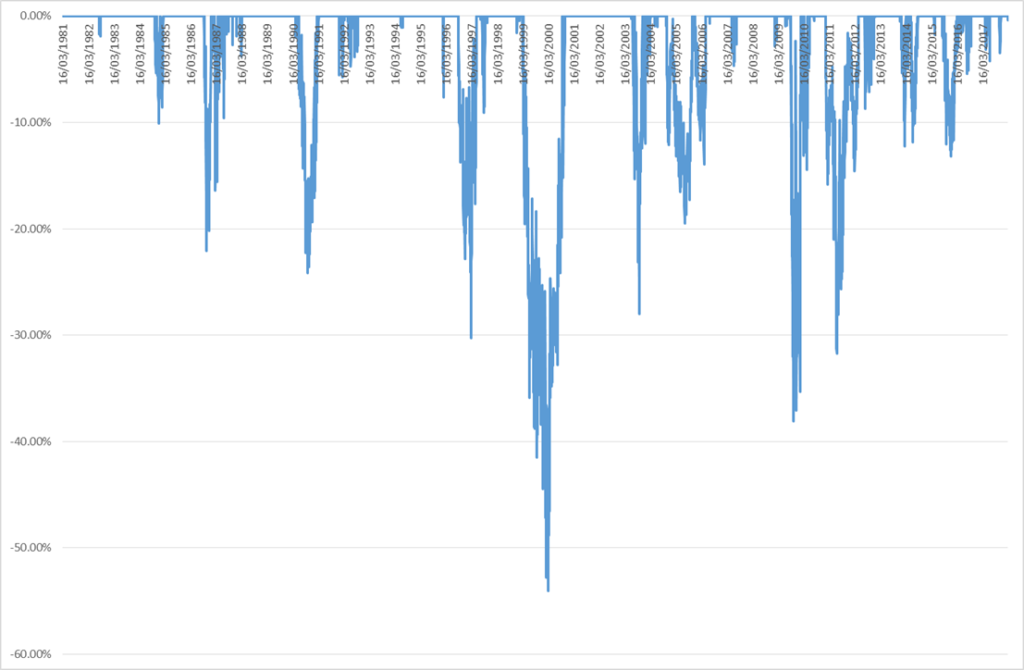

Below is a chart of the magnitude of Berkshire’s underperformance when it has underperformed:

Source: Bloomberg

The red line is the -10% threshold – you can see just how frequently and by how far this has been breached. It should be no surprise that this has usually happened prior to a big market fall – as Buffett has accumulated cash and not participated in much of the remaining upside when markets get expensive.

But this is the trade-off for the stellar long-term performance

Berkshire’s investors have been compensated for the periods of awful relative performance and for sticking with the investment process over the long term. That is the required trade-off – manage risk in the short term, ignore market noise and let the powers of compounding work in your favour.

Warren Buffett is also famous for his two rules of investing:

Rule no. 1: Never lose money

Rule no. 2: Never forget rule no. 1

Whilst it’s impossible in investing to never lose money (things that always go up generally turn out to be Ponzi schemes), his point is to manage risk with a laser focus.

How well have you been managing risk within your own portfolio?

With continued volatility expected for the remainder of 2018, it is critical to ensure you are well diversified and that your portfolios are regularly reviewed to ensure you’re in the best position possible.

If it’s been a while since you reviewed your investment mix, or if you’d like to confirm the level of risk is right for you, I’d encourage you to take advantage of our complimentary, no-obligation investment review if you are yet to do so – you can read some of the findings from recent reviews we’ve conducted here.

All we need to get started is a copy of your most recent portfolio statement and/or your superannuation statement, as well as a photo of your driver’s license to enable us to contact the relevant providers on your behalf. Click here to email this information directly to our team or click here if you’d like us to contact you with more information.

Liberum Financial Pty Ltd and its advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306 trading as Fortnum Financial Advisers. The information contained within this post does not consider your personal circumstances and is of a general nature only. You should not act on it without first obtaining professional financial advice specific to your circumstances. This post and website holds information for Australian residents only.

Comments are closed.