Diversify? Why Bother?

Over the years I have heard from many investors this very question – why bother diversifying? In their view, a portfolio of Australian shares, cash and term deposits does the trick. There are some perfectly good reasons for this.

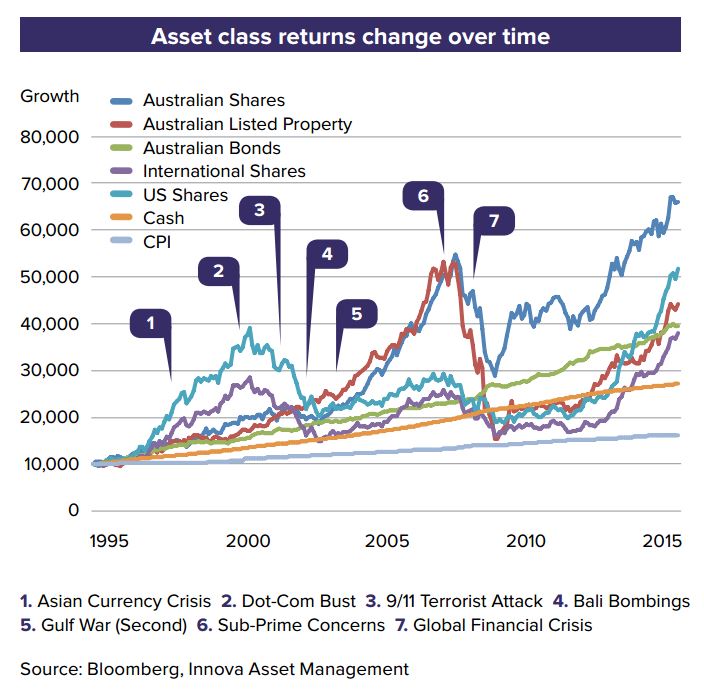

The following chart is often rolled out by large institutions to demonstrate how asset class returns change over time:

From this chart, Australian shares were the only place to be. If they’re too risky on their own, add in some cash and Term Deposits and you’re done. To further strengthen this argument, famous investors such as Warren Buffett and Charlie Munger are often quoted as saying that diversification is for those who don’t know how to invest.

With all due respect to Mr. Buffett and Mr. Munger, any investor who looks in the mirror in the morning and sees Warren Buffet staring back at them should probably start a career in stock picking. In addition, they’d need to be in a position where they don’t need to draw down on their investment and can wait 20 years for it to pay off. Very few investors indeed fit this profile, and if you are one of these lucky few, are you poring over the markets every day like Mr. Munger and Mr. Buffett? Also, even if you make some great investments that will pay off in the long term, life can sometimes get in the way. If you need to draw down on that investment for whatever reason (for example holidays, mortgage repayments, medical bills etc.) then the money is used and not available for the bounce back and strong long term returns that the investment can return. The money has been spent/ exhausted on something else.

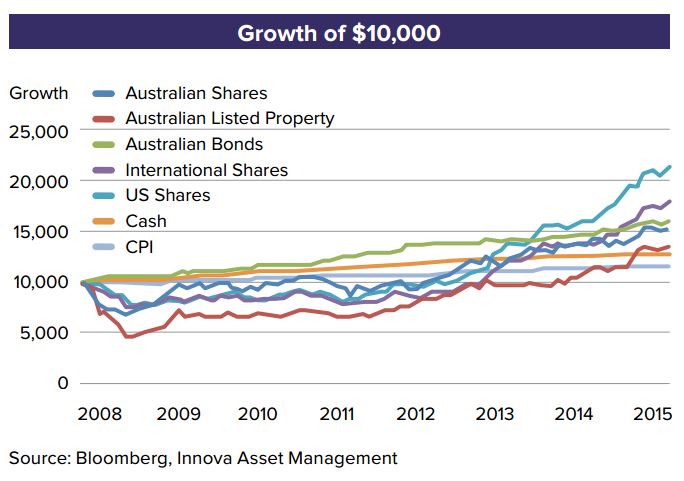

Instead, most investors consider the ‘long term’ to be about 7 years. How does the above chart look over the last 7 years?

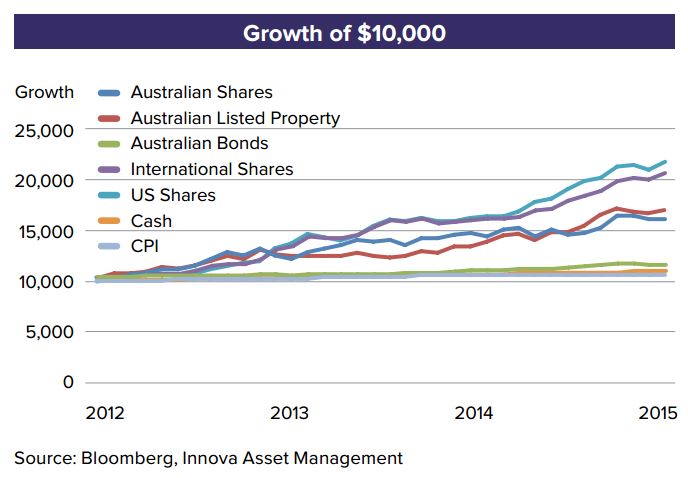

We’re now starting to see a different story. Even bonds, which are supposed to have less ‘risk’(1) and therefore less return have done better than Australian shares. Just for good measure, what about 3 years? The reality is that anyone seeing a financial planner is likely to have their portfolio regularly reviewed and, if change is needed, the adviser will make changes to their portfolio – so 3 years is probably more realistic:

The above chart shows the stark contrast in performance between Australian Shares and International Shares. Innova has previously published a paper on why one would diversify into International Shares at the expense of Australian Shares(2).

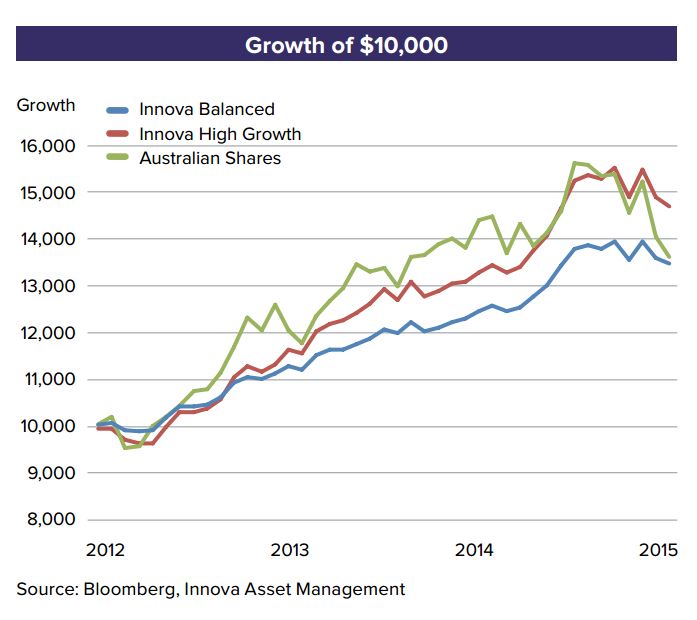

If we take this one step further and look at performance of a well-diversified portfolio that includes a series of asset classes and strategies, the benefits of diversification become very obvious.

Below is the performance of Innova’s Balanced and High Growth strategies when compared to Australian Shares since commencement.

The High Growth portfolio is much further diversified by security and asset class, but has arguably the same level of aggressiveness. The Balanced portfolio is further diversified and with much less aggressiveness in terms of return sought:

Innova pride themselves on being risk managers – in fact, that is the key focus of Innova. This can be seen with the greater level of stability in the performance charts – the dips aren’t as big and the swings are much smaller. These charts show that our investment programs are designed to manage investment risk and ensure our investors get an adequate return for that risk. They also show that our more ‘aggressive’ portfolio would have made investors more money with less investment risk than investing just in Australian shares. Our Balanced portfolio would have made almost the same amount of money with significantly less investment risk.

So if you have an adviser who has promoted the values of asset class diversification to you, ensured that your portfolio is well diversified and invested with the right people who are managing portfolio risk on your behalf, it is certainly likely to have benefited you greatly and reduced your exposure to excessive risk – you have more money in your account and you can sleep better at night.

Who wants more than that from an investment portfolio?

Dan Miles

MD and Co-CIO

Innova Asset Management

(1) Innova believe risk should be looked at from a number of different angles and therefore definitions, but the typical, market definition of ‘risk’ prevails here

(2) Please refer to paper found at www.innovaam.com.au

The information provided is general in nature and does not take into account your particular investment objectives, financial situation or insurance needs; we therefore recommend you seek advice tailored to your individual circumstances before making any specific decisions.

Liberum Financial and its advisers are Authorised Representatives of Fortnum Private Wealth Pty Ltd ABN 54 139 889 535 AFSL 357306 Australia Credit Licence No 357306 trading as Fortnum Financial Advisers.

Credit Original Source: For author information and disclaimers:-

http://innovaam.com.au/sites/default/files/201511_diversification.pdf

Comments are closed.